In this digital era, who even does the paperwork anymore?

Waiting weeks to learn if you qualify for a loan is no longer acceptable in the fast-paced world of today. Knowing your loan eligibility up front saves time, effort, and needless credit hits, whether you’re in need of quick cash, are planning a home improvement, or are experiencing a financial emergency. A quick loan eligibility check can save hours of your time. After all, a stitch in time saves nine.

Not only that, but the problem also arises with many underprivileged people or people who are not fluent in financial literacy. They might not be able to understand the paperwork, go through the legal procedure, or check loan eligibility.

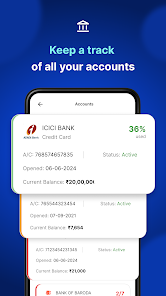

A loan app can help in such situations. With just a few clicks, you can check your eligibility with modern loan apps, eliminating the need to submit a ton of paperwork and wait days for a response.

You can download any app of your choice on your mobile phone, enter basic details such as your name and card number, etc., get authenticated, and there you go. The app will tell you whether or not you are eligible for your desired loan and get quick loan approval.

The app retrieves your credit score from credit bureaus such as CIBIL or Experian. Based on this information, you receive a real-time eligibility result, which includes the loan amount, interest rates, and repayment terms.

A high credit score (700 or higher) offers two benefits: better interest rates and a higher likelihood of approval.

Salaried applicants are frequently approved more quickly. Professionals who work for themselves have to demonstrate a history of consistent income.

Loan eligibility checks also display your eligible amount range to help you avoid overborrowing or applying for more loans than you’re likely to receive.

If you use reliable apps with banks or NBFCs that are registered with the RBI as partners, it is safe to check your eligibility online. Reputable apps never conduct a hard inquiry during the eligibility stage, encrypt your data, and never share your information without permission.

Adhere to platforms with RBI-compliant privacy policies, transparent terms and conditions, and verified app store reviews.

With the right safety measures and attention to all the terms and conditions, you can secure your loan very safely.

The fintech companies that grant these loans are of much lower amounts than traditional banks and have varied EMI ranges. Which type of loan you want to choose and how you want to repay it should be a very informed decision after a lot of research.

Loans are basic to the economy; not only do they help build and develop infrastructure, but they also help us achieve our dreams. If your study abroad application felt a little out of pocket or the business development you always dreamed of required more cash than you had, then loans could come and save the day and make your dreams feel a little closer to you.

Thanks to modern fintech advancements, you no longer need to fill out paperwork, wait in line, or understand complicated jargon to determine your loan eligibility. Your smartphone and a few simple details are all you need.