Young Indians today are earning, spending, and saving—but not investing. While we’re quick to embrace the latest technology and trends, when it comes to creating wealth, many of us don’t start simply because we don’t know where to start. Conventional financial education hardly equips us with practical money-making decisions in real life, leaving a financial gap between making money and making it grow.

But here’s the thing: you don’t have to be an expert in finance to begin investing. With easy-to-use Indian trading apps and affordable digital tools, trading and investing are simpler than ever before for millennials. If you’re interested in learning how to let your money do the work, this blog takes you by the hand through everything you need to know to begin—from choosing a trading platform to creating your investment portfolio.

Selecting the Proper Trading Platform

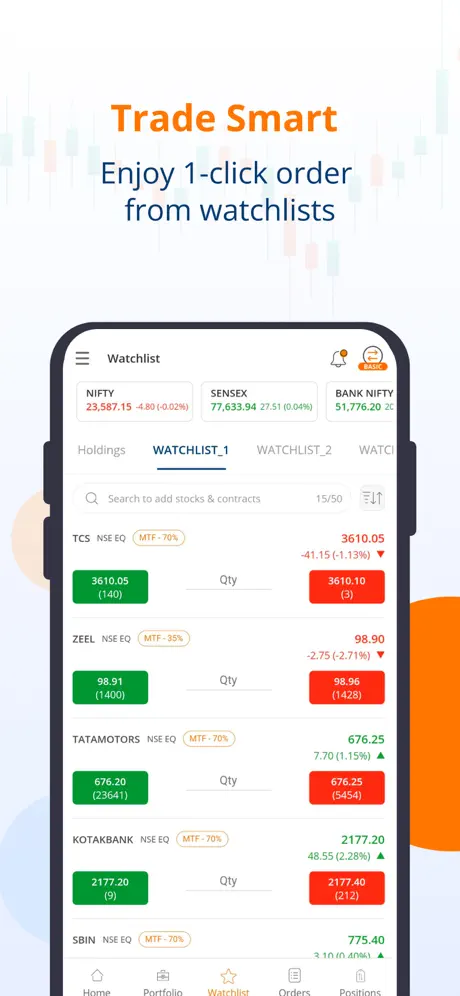

A trading platform is an online window through which you can purchase and sell equities, mutual funds, or commodities. For youth investors, selecting a simple and dependable platform is important. Go for platforms that:

- Have a simple interface

- Offer learning materials

- Provide real-time information

- Facilitate easy integration with an Indian trading app

There are different apps becoming popular with Indian youngsters for their ease of use and minimal brokerage fees.

How to Open Demat Account

To start trading, the initial step is to open a demat account. A demat (dematerialised) account holds your shares in electronic form, making it easy to manage and transfer. Here’s a quick process:

- Choose a SEBI-registered broker or an Indian trading app.

- Submit KYC documents like Aadhaar, PAN, and bank details.

- Complete e-verification through your mobile number and email.

- After approval, connect it to your brokerage account to begin trading.

- The whole procedure is typically not more than 24 hours.

Know Brokerage Accounts

A brokerage account is where you hold money ready to invest. It’s associated with your trading and demat account and serves as the wallet from which you sell and purchase financial products. Brokers incur a small cost, called brokerage, on each transaction. Being a beginner, take a discount broker that provides low-cost schemes.

Building an Investment Portfolio

An investment portfolio is a group of funds such as stocks, mutual funds, ETFs, and even gold. At your age, your portfolio can be more about learning and growth than profits. Here are some fast tips:

- Invest a small amount and keep investing more and more

- Don’t invest all your money in a single stock

- Keep a tab on market trends

- Keep checking how your portfolio is doing

- Invest in businesses you know—such as consumer goods or tech start-ups—and watch them grow.

Risk Management is Crucial

Trading is not all about wins; there are losses involved as well. It is important to:

- Invest within a budget

- Not take loans to invest

- Employ stop-loss orders in order to control risk

- Do not invest in emotions or because of peer pressure

- The idea is to learn and experience, and not gamble.

Conclusion:

Beginning young in trading provides you with a huge advantage in creating permanent wealth. With the appropriate trading platform, a confirmed demat account, and a diversified investment portfolio, you can start your financial journey intelligently. Check out the best Indian trading app, do your research, and trade judiciously.