Long-term financial development is about wise planning, consistent investing, and—most importantly—tracking your investments; it is not about luck. Knowing how your investments perform over time helps you make wise decisions and prevent expensive mistakes whether you are investing your cash in mutual funds, equities, or money market funds.

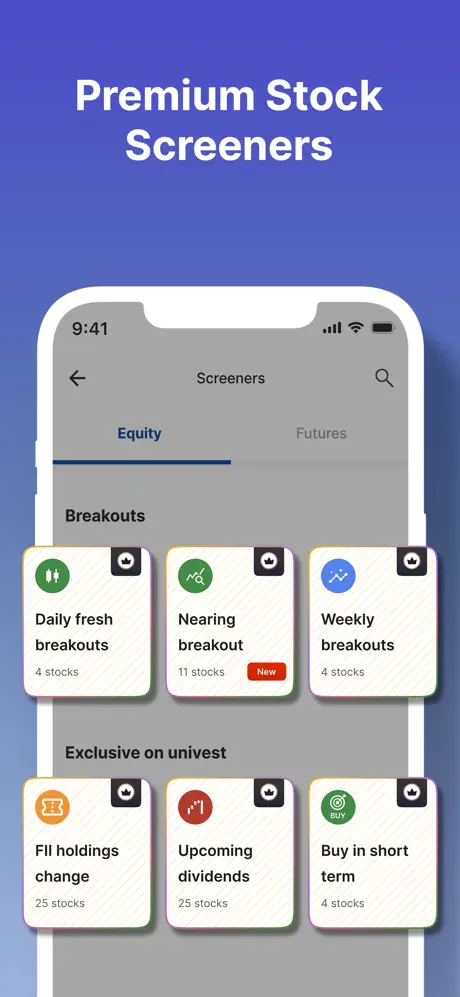

Thanks to instruments like a wealth management app or an Indian trading app, tracking investments has become simpler than ever in the digital age of today. Why, though, is monitoring so crucial? Let’s start with the causes.

1. maintains your alignment with financial goals.

Tracking your investments is mostly driven by your need to make sure you are headed toward your financial goals. Do you have retirement in mind when investing? A child’s education? Purchasing a house Whatever your objective, consistent monitoring helps you to control your advancement.

Early tracking lets you rebalance or change strategy if your mutual fund investments aren’t growing at the planned rate or if a money market fund is underperforming before it’s too late.

2. identifies underperforming assets.

Not every investment pays off as hoped. Certain equities might drop, mutual funds could stand still, or money market funds might not provide sufficient returns. Regular portfolio tracking helps you to rapidly find these laggards.

Once found, you might decide to sell, change your investment in them, or just cut back. This proactive approach helps long-term expansion and keeps your whole portfolio strong.

3. promotes disciplined investing.

Discipline is essential for both saving and evaluating and changing your assets, so contributing significantly to your financial success. Frequent tracking fosters a habit. Reviewing your stocks or mutual fund investments either regularly or quarterly naturally helps you to stay more informed.

Setting up automatic reminders, growth trackers, and allocation notifications using a wealth management app will assist to maintain your financial discipline strong.

4. Make use of compound.

Monitoring enables you to better grasp real-time compounding dynamics. Compounding is very important for increasing your money whether you make mutual fund investments or money market funds. Seeing your money grow over months and years inspires you to maintain committed.

Useful tools for long-term wealth development, many Indian trading apps today include historical return tracking and growth estimates.

5. Makes Tax Planning Simpler

Monitoring your investments at the conclusion of the financial year facilitates tax preparation. Your gains or losses will show you which funds qualify for tax benefits (such as ELSS), and what kind of capital gains you could have to pay taxes on.

When handling several portfolios spanning mutual fund investments, stocks via an Indian trading app, or other instruments such money market funds, this is very crucial.

Conclusion:

You must track your investments; it is not discretionary. Modern technologies like an Indian trading app or a wealth management software make keeping informed and in control simpler than it has ever been.

Invest not only and forget. Watch, examine, and adjust. Real, long-lasting financial success depends on keeping on top of your portfolio whether your investments are in mutual funds, money market funds, storing cash in technology tools, or something else entirely.

Tracking guarantees you stay on the correct road; financial success is about time in the market, not about timing the market.